|

Adam Butusov call or text 708-415-1432

Tripp Butusov call or text 910-988-8729

0 Comments

starting or expanding a business is absolutely exciting. call us today to start your property search. we have attached a business analysis report. Check it out! call us to discuss your commercial real estate needs. k

|

|||||||||||||||

|

| ||||||||||||

Depending where you live in Brookfield, your high school student will either attend Riverside-Brookfield High School or Lyons Township High School.

Both High Schools are pretty great. Lyons Township has two campuses. Neither LTHS schools are too far away from each other but it makes a big difference with the hub bub in our daily lives.

Our communities are really lucky to have great K-12 schools. If you are looking for more information, get in touch and we will help you navigate everything Brookfield including the schools!

Feel free to access the attached reports. Thanks for stopping by our blog!

Both High Schools are pretty great. Lyons Township has two campuses. Neither LTHS schools are too far away from each other but it makes a big difference with the hub bub in our daily lives.

Our communities are really lucky to have great K-12 schools. If you are looking for more information, get in touch and we will help you navigate everything Brookfield including the schools!

Feel free to access the attached reports. Thanks for stopping by our blog!

Getting ready to sell your house? Then it's time to roll up your sleeves and get to work! Selling a home, after all, entails a whole lot more than just planting a "For Sale" sign on your front lawn or uploading a few random photos of your place--especially if you’re angling for the most cash. (And, honestly, who isn’t?)So before you put your house on the market, peruse this checklist of things you must do in preparation. Some of these tips are surprisingly easy, while others might require a bit more elbow grease. But they're bound to pay off once buyers start oohing and ahhing over your place—and hopefully ponying up a great offer.

1. Find a great real estate agent (get in touch with one here)

Think you can sell your home yourself, and pocket the cash you would otherwise pay an agent? It can be tempting, especially in a hot market, but resist the urge, says William Butusov, a real estate consultant with Charles Rutenberg Realty in Naperville. He’s found that a "For Sale by Owner" transaction is almost always a disaster, leading you to sacrifice both money and time. In the long term home owners trying to sell their home on their own ended up after a few weeks hiring a Realtor. Home owners should approach it selling their home like this, who is their day time coverage person? Most people are at work, school and other engagements. Home owners have not vetted anyone that say that they drove by the house, saw the sign and called. Now a stranger that has not been vetted is roaming around your house. Local Realtor Adam Butusov with over 17 years in the industry says "we screen the clients, we make sure that they have started the home buying processes and more importantly we are the day time coverage while you’re at work and such". We are maximizing the exposure time and ensuring that your house is getting the attention that it needs to be sold as quickly as possible.

2. Consider your curb appeal

Make sure the first thing prospective buyers see of your home entices them to want to see more. Yes, for better or worse, buyers do tend to judge a book by its cover. By investing some effort in relatively easy fixeslike planting colorful flowers and repainting your front door, the outside of your house can beckon them to come on in. Your local Realtor can help point you in the right direction for more specifics I suggest the Sell35 team #charlesrutenbergrealty. They are local and have been in the Real-estate business for 18 years. They also have extensive knowledge and a great relationship with the La Grange, Brookfield and West Suburbs community. Connect to the team directly here!

3. Declutter living areas

Less is definitely more when it comes to getting your house ready to show. Do a clean sweep of counters, windowsills, tables, and all other visible areas, and then tackle behind closed doors: closets, drawers, and cupboards—since virtually nothing is off-limits for curious buyers. And if the house is overflowing with stuff, they might worry that the house won’t have ample space for their own belongings.

Take the excess and donate or pack it up for a storage space. The bonus to taking care of this now is that it’s one less chore you’ll have to do when it’s actually time to move.

4. Depersonalize your space

The next step on your declutter list? You want to remove any distractions so the buyers can visualize themselves and their family living in the property. This includes personal items and family photos, as well as bold artwork and furniture that might make your home less appealing to the general public. The goal is to create a blank canvas on which house hunters can project their own visions of living there, and loving it.

5. Repaint walls to neutral tones

You might love that orange accent wall, but if it’s your potential buyer’s least favorite color, that could be a turnoff, warns Reale-estate experts. “You’re pretty safe with a neutral color because it's rare that someone hates it, but the other benefit is that a light color allows [buyers] to envision what the walls would look like with the color of their choice,” he points out.

6. Touch up any scuff marks

Even if you’re not doing a full-on repainting project, pay special attention to scrubbing and then touching up baseboards, walls, and doors to make the house sparkle and look cared-for.

7. Fix any loose handles

A small thing, sure, but you’d be surprised by the negative effect a loose handle or missing lightbulb can have on a buyer. “It can make them stop and think, ‘What else is broken here?’"

8. Add some plants

Green is good, because plants create a more welcoming environment. You might also want to consider a bouquet of flowers or bowl of fruit on the kitchen counter or dining table.

9. Conduct a smell test

Foul odors, even slight ones, can be a deal breaker, and the problem is that you might not even notice them, says Sharapan Fabrikant. He recommends inviting an unbiased third party in to try to detect any pet smells or lingering odors from your kitchen. If the smells are pervasive, you might need to do some deep cleaning, because many buyers are on to your “masking techniques” such as candles or plug-in room deodorizers.

10. Clean, clean, clean

And then clean some more. You want your property to look spotless. Take special care with the bathroom, making sure the tile, counters, shower, and floors shine.

11. Hide valuables

From art to jewelry, make sure that your treasures are out of sight, either locked up or stored offsite.

12. Consider staging

Does your house scream 1985? Nothing invigorates a house like some new furnishings or even just a perfectly chosen mirror. The key is getting your home staged by a professional. Home stagers will evaluate the current condition and belongings in your house and determine what elements might raise the bar. They might recommend you buy or rent some items, or they might just reorganize your knickknacks and bookshelves in a whole new (that is, better) way.

These are just some suggestions the local Real-estate experts from your Sell35 team would recommend doing before you list your home to sell. Sell35 team believes that these simple recommendations will tremendously assist in the selling of your home as quickly as possible. Spring market is about to begin! Now is the time, make a list and tackle theses items one at a time. This way it won’t seem like an overbearing and stressful task. Your Sell35 team will be able to help you prioritize and come up with a simple and effective list to start with. Contact Adam Butusov with Sell35 #charlesrutenbergrealty today. They are local, responsive and only charge 3.5% total commission for selling homes. They know the West Suburbs, La Grange, Brookfield, Westmont and Hinsdale to mention a few. Try us out for free and see whats your home worth by clicking here!

1. Find a great real estate agent (get in touch with one here)

Think you can sell your home yourself, and pocket the cash you would otherwise pay an agent? It can be tempting, especially in a hot market, but resist the urge, says William Butusov, a real estate consultant with Charles Rutenberg Realty in Naperville. He’s found that a "For Sale by Owner" transaction is almost always a disaster, leading you to sacrifice both money and time. In the long term home owners trying to sell their home on their own ended up after a few weeks hiring a Realtor. Home owners should approach it selling their home like this, who is their day time coverage person? Most people are at work, school and other engagements. Home owners have not vetted anyone that say that they drove by the house, saw the sign and called. Now a stranger that has not been vetted is roaming around your house. Local Realtor Adam Butusov with over 17 years in the industry says "we screen the clients, we make sure that they have started the home buying processes and more importantly we are the day time coverage while you’re at work and such". We are maximizing the exposure time and ensuring that your house is getting the attention that it needs to be sold as quickly as possible.

2. Consider your curb appeal

Make sure the first thing prospective buyers see of your home entices them to want to see more. Yes, for better or worse, buyers do tend to judge a book by its cover. By investing some effort in relatively easy fixeslike planting colorful flowers and repainting your front door, the outside of your house can beckon them to come on in. Your local Realtor can help point you in the right direction for more specifics I suggest the Sell35 team #charlesrutenbergrealty. They are local and have been in the Real-estate business for 18 years. They also have extensive knowledge and a great relationship with the La Grange, Brookfield and West Suburbs community. Connect to the team directly here!

3. Declutter living areas

Less is definitely more when it comes to getting your house ready to show. Do a clean sweep of counters, windowsills, tables, and all other visible areas, and then tackle behind closed doors: closets, drawers, and cupboards—since virtually nothing is off-limits for curious buyers. And if the house is overflowing with stuff, they might worry that the house won’t have ample space for their own belongings.

Take the excess and donate or pack it up for a storage space. The bonus to taking care of this now is that it’s one less chore you’ll have to do when it’s actually time to move.

4. Depersonalize your space

The next step on your declutter list? You want to remove any distractions so the buyers can visualize themselves and their family living in the property. This includes personal items and family photos, as well as bold artwork and furniture that might make your home less appealing to the general public. The goal is to create a blank canvas on which house hunters can project their own visions of living there, and loving it.

5. Repaint walls to neutral tones

You might love that orange accent wall, but if it’s your potential buyer’s least favorite color, that could be a turnoff, warns Reale-estate experts. “You’re pretty safe with a neutral color because it's rare that someone hates it, but the other benefit is that a light color allows [buyers] to envision what the walls would look like with the color of their choice,” he points out.

6. Touch up any scuff marks

Even if you’re not doing a full-on repainting project, pay special attention to scrubbing and then touching up baseboards, walls, and doors to make the house sparkle and look cared-for.

7. Fix any loose handles

A small thing, sure, but you’d be surprised by the negative effect a loose handle or missing lightbulb can have on a buyer. “It can make them stop and think, ‘What else is broken here?’"

8. Add some plants

Green is good, because plants create a more welcoming environment. You might also want to consider a bouquet of flowers or bowl of fruit on the kitchen counter or dining table.

9. Conduct a smell test

Foul odors, even slight ones, can be a deal breaker, and the problem is that you might not even notice them, says Sharapan Fabrikant. He recommends inviting an unbiased third party in to try to detect any pet smells or lingering odors from your kitchen. If the smells are pervasive, you might need to do some deep cleaning, because many buyers are on to your “masking techniques” such as candles or plug-in room deodorizers.

10. Clean, clean, clean

And then clean some more. You want your property to look spotless. Take special care with the bathroom, making sure the tile, counters, shower, and floors shine.

11. Hide valuables

From art to jewelry, make sure that your treasures are out of sight, either locked up or stored offsite.

12. Consider staging

Does your house scream 1985? Nothing invigorates a house like some new furnishings or even just a perfectly chosen mirror. The key is getting your home staged by a professional. Home stagers will evaluate the current condition and belongings in your house and determine what elements might raise the bar. They might recommend you buy or rent some items, or they might just reorganize your knickknacks and bookshelves in a whole new (that is, better) way.

These are just some suggestions the local Real-estate experts from your Sell35 team would recommend doing before you list your home to sell. Sell35 team believes that these simple recommendations will tremendously assist in the selling of your home as quickly as possible. Spring market is about to begin! Now is the time, make a list and tackle theses items one at a time. This way it won’t seem like an overbearing and stressful task. Your Sell35 team will be able to help you prioritize and come up with a simple and effective list to start with. Contact Adam Butusov with Sell35 #charlesrutenbergrealty today. They are local, responsive and only charge 3.5% total commission for selling homes. They know the West Suburbs, La Grange, Brookfield, Westmont and Hinsdale to mention a few. Try us out for free and see whats your home worth by clicking here!

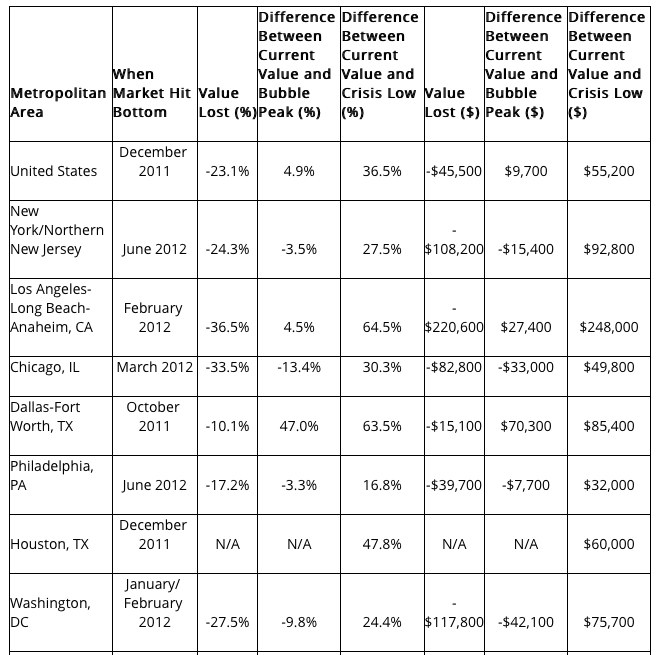

The U.S. housing market has gained back all $9 trillion in value lost during the 2007 recession,t. Furthermore, the average U.S. home is now worth $55,200 more than it was at the bottom of the housing bust.

Zillow says West Coast markets have fared the best since 2007, thanks to robust job growth and low inventory that has pushed home values up. On the other hand, (California, Florida, Arizona and Nevada), excluding California, have yet to fully recover from the disproportionate impact the housing bust had on them.

The median home in San Jose and Las Vegas dropped $190,000 in value during the recession, but today, homes in Las Vegas have only regained $130,000 in value — leaving a $60,000 gap. Meanwhile, the median home price in San Jose is $615,000, three times the value that was lost.

During the recession, San Francisco homes lost $225,000 in value, but now, homes have gained 91.7 percent of their value back from the December 2012 crisis low, bringing the median home value to $435,700. Los Angeles and San Diego have experienced relatively strong recoveries with homes gaining back 64.5 and 62.6 percent of their value from the crisis low, respectively.

Meanwhile, Zillow classifies Denver as an outlier that didn’t experience much of a housing bust, since home values only fell 9 percent. But Denver median home values have climbed to $379,500 — 61 percent higher than the highest value reached during the mid-2000s bubble.

“A decade after the financial crisis, the scars of the housing bust are still with us,” said Zillow senior economist Aaron Terrazas in a press release. “The gap between the metros with the strongest and weakest housing market recoveries is as wide as it has ever been.”

Click here to find out what your home value is

“The California Bay Area’s housing recovery stands out when compared to other markets that saw similar home value appreciation because it has more than regained all of its lost value,” Terrazas added. “Strong, high-paying job markets and persistently limited inventory sent prices skyrocketing, leading to the Bay Area having the most valuable housing markets in the country.”

Click here to view current area information

Zillow says West Coast markets have fared the best since 2007, thanks to robust job growth and low inventory that has pushed home values up. On the other hand, (California, Florida, Arizona and Nevada), excluding California, have yet to fully recover from the disproportionate impact the housing bust had on them.

The median home in San Jose and Las Vegas dropped $190,000 in value during the recession, but today, homes in Las Vegas have only regained $130,000 in value — leaving a $60,000 gap. Meanwhile, the median home price in San Jose is $615,000, three times the value that was lost.

During the recession, San Francisco homes lost $225,000 in value, but now, homes have gained 91.7 percent of their value back from the December 2012 crisis low, bringing the median home value to $435,700. Los Angeles and San Diego have experienced relatively strong recoveries with homes gaining back 64.5 and 62.6 percent of their value from the crisis low, respectively.

Meanwhile, Zillow classifies Denver as an outlier that didn’t experience much of a housing bust, since home values only fell 9 percent. But Denver median home values have climbed to $379,500 — 61 percent higher than the highest value reached during the mid-2000s bubble.

“A decade after the financial crisis, the scars of the housing bust are still with us,” said Zillow senior economist Aaron Terrazas in a press release. “The gap between the metros with the strongest and weakest housing market recoveries is as wide as it has ever been.”

Click here to find out what your home value is

“The California Bay Area’s housing recovery stands out when compared to other markets that saw similar home value appreciation because it has more than regained all of its lost value,” Terrazas added. “Strong, high-paying job markets and persistently limited inventory sent prices skyrocketing, leading to the Bay Area having the most valuable housing markets in the country.”

Click here to view current area information

Located just 13 miles west of downtown Chicago, Brookfield is a close-in suburb combining the best of city and suburban living. The Village offers cultural amenities and easy access to downtown Chicago, while providing families the great schools and conveniences of suburban living.

Brookfield is a vibrant diverse community of 19,085 individuals supporting a variety of churches, good schools, an excellent library, low taxes, convenient transportation, and extensive parks and recreation programs. We are committed to economic development, modernizing, building, and making our neighborhoods better and safer. Whether shopping, dining, or enjoying the world-class Brookfield Zoo, you will find our village a remarkable and friendly place. A great place to live, raise a family, shop, and do business, Brookfield is truly a community in every sense of the word.

HISTORY OF BROOKFIELD, IL

In 1994 a number of citizens and local historians teamed up to publish a remarkable 388 page hardbound book with hundreds of photographs named “Brookfield Illinois, A History.” Most of the information below was excerpted from this valuable resource. The book is available in the Public Library, and may be purchased from the Brookfield Historical Society housed in the original Grossdale train station on Brookfield Avenue just east of Prairie Avenue. The book can occasionally be found new and used on Amazon.com.

Before 1803. The area now called Brookfield is mostly covered by prairie grasses, forests, and farms. Large portions of the area are inhabited by the native Americans who long ago developed agriculture and corn cultivation, built villages and burial mounds, invented the bow and arrow, and made beautiful pottery.

1803-1816. The US Government captures and purchases most of northern Illinois from Chippewa, Ottawa, Pottawatomi, Kickapoo, and Kaskaskia tribes.

December 1818. The Illinois Teritory becomes the 21st state.

May 20, 1864. The Chicago, Burlington & Quincy Railroad begins running freight along its recently completed Chicago-to-Aurora Line.

December 1, 1888. Samuel Eberly Gross, a lawyer turned real estate investor from Chicago, begins buying large parcels of farm, prairie, and woods along both sides of the track about 13 miles west of the city. He immediately begins planning to divide the area into streets and lots, and drafts a complex plan for a village with affordable housing for working class families.

June 15, 1889. Gross opens “Grossdale” and begins offering lots for sale. The first two buildings are a train station south of the tracks at what is now Prairie Avenue, and a Pavillion across the tracks. The original train station was moved across the tracks and a few hundred feet east in 1981, and is now the home of the Village’s Historical Society and museum. The Pavillion housed the first post office, general store, Gross’ real estate office, meeting rooms, and eventually a dance Hall. Gross betgins offering free train outings from Chicago to Grossdale where the prospects are met at the station by a band and treated to a picnic lunch complete with a sales pitch from Gross. In addition to parcels of land, he has a number of house designs to offer at “cheap” prices.

November 7, 1893. Early residents vote to incorporate Grossdale, the official date of the founding of what is now Brookfield.

January 2, 1894. The first Village Board meets.

1905. Grossdale’s name is changed to Brookfield.

1918. Riverside Brookfield High School opens. RB beats Oak Park in basketball to win the Suburban League Championship.

1920. The Plank Toll Road, now called Ogden Avenue, is paved in cement providing easy automobile access.

July 1, 1934. The Chicago Zoological Park opens. It is commonly called the Brookfield Zoo, and quickly grows to gain international fame as a zoo, educational institution, and research facility.

1947. The Village’s finances are so bad that bankruptcy is discussed, but Illinois law prohibits it. Backs to the wall, hundreds of residents volunteer to make sure all lots listed as empty are really empty and that all buildings are properly assessed and on the tax rolls. Hundreds of water leaks are stanched to drastically reduce the Village’s water bill from Chicago. To further combat the Village’s financial problems, Brookfield pioneers the concept of using a full-time Village Manager to oversee the Village’s affairs. It is so successful that the state begins recommending it to other villages.

1952. Citing Brookfield’s remarkable recovery from the brink of insolvency, The National Municipal League and Look Magazine give Brookfield and 10 other municipalities the title “All American City.”

1958. The Village’s Public Works Department installs a traffic circle at the treacherous intersection known as “eight corners” transforming it from harrowing to merely hair raising. Miss America, Mary Ann Mobley, and three bands are on hand for the dedication.

1976. Brookfield is named a “Bicentennial Community” and gets one of 111 replicas of the Liberty Bell cast from the same mold as the original in Philadelphia.

1981. Brookfield is named a “Tree City USA.” The new water tower sporting the now famous logo of two porpoises from the Brookfield Zoo is erected.

December 23, 1987. The Village of Brookfield and the City of Moe, Australia become sister cities. Moe is similar in size and economic structure, and it is located 135 km east of Melbourne.

1991. The Irish Times opens for business, and becomes an “anchor” for the downtown business district. Owner Martin Lynch (native of County Galway, Ireland) takes over the family business in 2008, subsequently expands the restaurant space and menu offerings. It is now recognized as one of the preeminent Irish pubs in greater Chicago.

2010. The Galloping Ghost Arcade opens. The video arcade (notable for its amazing collection of retro and futuristic video games), is estimated to be the largest video arcade in the United States with over 400 video and pinball games.

2014. The Village of Brookfield celebrates the 125th anniversary of the original “Grossdale” train station. The train station is now on the National Register of Historic Places, one block from current Brookfield train station and the downtown.

Brookfield is a vibrant diverse community of 19,085 individuals supporting a variety of churches, good schools, an excellent library, low taxes, convenient transportation, and extensive parks and recreation programs. We are committed to economic development, modernizing, building, and making our neighborhoods better and safer. Whether shopping, dining, or enjoying the world-class Brookfield Zoo, you will find our village a remarkable and friendly place. A great place to live, raise a family, shop, and do business, Brookfield is truly a community in every sense of the word.

HISTORY OF BROOKFIELD, IL

In 1994 a number of citizens and local historians teamed up to publish a remarkable 388 page hardbound book with hundreds of photographs named “Brookfield Illinois, A History.” Most of the information below was excerpted from this valuable resource. The book is available in the Public Library, and may be purchased from the Brookfield Historical Society housed in the original Grossdale train station on Brookfield Avenue just east of Prairie Avenue. The book can occasionally be found new and used on Amazon.com.

Before 1803. The area now called Brookfield is mostly covered by prairie grasses, forests, and farms. Large portions of the area are inhabited by the native Americans who long ago developed agriculture and corn cultivation, built villages and burial mounds, invented the bow and arrow, and made beautiful pottery.

1803-1816. The US Government captures and purchases most of northern Illinois from Chippewa, Ottawa, Pottawatomi, Kickapoo, and Kaskaskia tribes.

December 1818. The Illinois Teritory becomes the 21st state.

May 20, 1864. The Chicago, Burlington & Quincy Railroad begins running freight along its recently completed Chicago-to-Aurora Line.

December 1, 1888. Samuel Eberly Gross, a lawyer turned real estate investor from Chicago, begins buying large parcels of farm, prairie, and woods along both sides of the track about 13 miles west of the city. He immediately begins planning to divide the area into streets and lots, and drafts a complex plan for a village with affordable housing for working class families.

June 15, 1889. Gross opens “Grossdale” and begins offering lots for sale. The first two buildings are a train station south of the tracks at what is now Prairie Avenue, and a Pavillion across the tracks. The original train station was moved across the tracks and a few hundred feet east in 1981, and is now the home of the Village’s Historical Society and museum. The Pavillion housed the first post office, general store, Gross’ real estate office, meeting rooms, and eventually a dance Hall. Gross betgins offering free train outings from Chicago to Grossdale where the prospects are met at the station by a band and treated to a picnic lunch complete with a sales pitch from Gross. In addition to parcels of land, he has a number of house designs to offer at “cheap” prices.

November 7, 1893. Early residents vote to incorporate Grossdale, the official date of the founding of what is now Brookfield.

January 2, 1894. The first Village Board meets.

1905. Grossdale’s name is changed to Brookfield.

1918. Riverside Brookfield High School opens. RB beats Oak Park in basketball to win the Suburban League Championship.

1920. The Plank Toll Road, now called Ogden Avenue, is paved in cement providing easy automobile access.

July 1, 1934. The Chicago Zoological Park opens. It is commonly called the Brookfield Zoo, and quickly grows to gain international fame as a zoo, educational institution, and research facility.

1947. The Village’s finances are so bad that bankruptcy is discussed, but Illinois law prohibits it. Backs to the wall, hundreds of residents volunteer to make sure all lots listed as empty are really empty and that all buildings are properly assessed and on the tax rolls. Hundreds of water leaks are stanched to drastically reduce the Village’s water bill from Chicago. To further combat the Village’s financial problems, Brookfield pioneers the concept of using a full-time Village Manager to oversee the Village’s affairs. It is so successful that the state begins recommending it to other villages.

1952. Citing Brookfield’s remarkable recovery from the brink of insolvency, The National Municipal League and Look Magazine give Brookfield and 10 other municipalities the title “All American City.”

1958. The Village’s Public Works Department installs a traffic circle at the treacherous intersection known as “eight corners” transforming it from harrowing to merely hair raising. Miss America, Mary Ann Mobley, and three bands are on hand for the dedication.

1976. Brookfield is named a “Bicentennial Community” and gets one of 111 replicas of the Liberty Bell cast from the same mold as the original in Philadelphia.

1981. Brookfield is named a “Tree City USA.” The new water tower sporting the now famous logo of two porpoises from the Brookfield Zoo is erected.

December 23, 1987. The Village of Brookfield and the City of Moe, Australia become sister cities. Moe is similar in size and economic structure, and it is located 135 km east of Melbourne.

1991. The Irish Times opens for business, and becomes an “anchor” for the downtown business district. Owner Martin Lynch (native of County Galway, Ireland) takes over the family business in 2008, subsequently expands the restaurant space and menu offerings. It is now recognized as one of the preeminent Irish pubs in greater Chicago.

2010. The Galloping Ghost Arcade opens. The video arcade (notable for its amazing collection of retro and futuristic video games), is estimated to be the largest video arcade in the United States with over 400 video and pinball games.

2014. The Village of Brookfield celebrates the 125th anniversary of the original “Grossdale” train station. The train station is now on the National Register of Historic Places, one block from current Brookfield train station and the downtown.

I want to discuss the market dynamics and the difference from a few years back until today. The market clearly has changed for the better. A lot of this has to do with financing and the availability of financing. A number of years ago many banks had decided not to lend money. Other banks decided they would be overly conservative. Now that has all changed with the exception, or rather understanding that banks will only lend to credit worthy buyers who are buying buildings that are worthy of investment. What I mean by that is buildings must cash flow and realistic expenses must be considered such as management fees and vacancy factors. After all, buildings do require management and spaces do become vacant. These costs along with an understanding that maintenance reserves must be in place and considered allow for a reasonable projection of building performance. With that said, if the building has a debt service coverage ratio of 1.25, many banks will lend on the transaction. With interest rates being so low hovering around 4% and commercial rates at about 5% it is reasonable to assume a cap rate of 6.25 will be adequate to meet at 1.25 debt service coverage ratio. If you are a seller or an owner of an apartment building or commercial property that is considering selling a capitalization rate of 6.25 can be expected if you have an investment grade building or a building that has a durable income stream such as apartments. What this means to you as a seller or owner of the building is that the opportunity to sell is better today then it would be if the interest rates were slightly higher. For more information or to discuss market conditions and specifically your building please feel free to call us.

With the market being so strong and the fact that it is easier to sell than it had been, we are offering super low commissions. If the property is priced well and marketed properly you can expect to minimize your cost to maximize your profit. Call today, and we will discuss pricing and marketing strategy.

La Grange, Il

Western Springs, Il

Hinsdale, Il

Brookfield, Il

With the market being so strong and the fact that it is easier to sell than it had been, we are offering super low commissions. If the property is priced well and marketed properly you can expect to minimize your cost to maximize your profit. Call today, and we will discuss pricing and marketing strategy.

La Grange, Il

Western Springs, Il

Hinsdale, Il

Brookfield, Il

Parking Options

Lot Hours, Locations & Spaces

All parking lots listed below are open and free unless otherwise noted. For more information about parking, please contact the Police Department at (708) 579-2333. View a map of parking lots.

Downtown Valet Parking

Free valet parking is available on downtown La Grange on Friday and Saturday evenings from 5 p.m. to 10 p.m. Stations are located on the east side of La Grange Road - one south of Harris Avenue near the fountain and the other south of Burlington Avenue. A third station is located on the west side of La Grange Road south of Calendar Avenue.

Commuter Parking

View more information regarding commuter parking for the La Grange Road and Stone Avenue train stations.

Overnight Parking Restrictions

View the Village's overnight parking restrictions and requirements for both visitors and residents of La Grange.

_____________________________________________________________________

Parking Lot Hours, Locations & Spaces

> Monday - Saturday

3 hour free parking

6:00 am to 6:00 pm

(unless noted otherwise)

> Monday - Saturday Free Parking

6:00 pm to 2:00 am

- > Sunday

Free parking

6:00 am t0 2:00 am

Lot Location

Spaces

Lot 2

Sixth and Harris

Northeast cornerDecal parking only*Lot 3

Harris and Madison

North side of Harris33 three-hour spaces

Six handicapped spacesLot 4

Ashland and HarrisCentral Business District (CBD) decal parking only*Lot 5

Burlington - Ashland - Calendar

East side of Ashland181 three-hour spaces

Six handicapped spacesLot 8

Madison and Harris

South side of Harris43 three-hour spaces

Two handicapped spacesParking Deck

Sixth and Harris365 four-hour spaces

Three 10-minute spaces

Eight handicapped spacesLot 11

Sixth Avenue

1/4 block south of Burlington26 three-hour spaces

Two handicapped spacesLot 12

Burlington and Bluff38 decal-only spaces*

(Commuter parking 6:00 am - 6:00 pm)

Lot 13

Brainard and Bulington Commuter Parking Only* Lot is owned by railroad.

Commuters must provide copy of current train pass.

No parking is permitted for Lyons Township High School.

*Decal spaces are for business, residential and/or commuter parking only - Monday through Saturday, 6:00 am to 6:00 pm.

What are you buying or selling you want to be informed. There's a lot of misleading information on the Internet navigating through all of it can be really tough!

How about those Zestimates of home values?

Zillow states the following

Real estate professionals sometimes get inquiries from prospective real estate buyers and sellers about the Zestimate. Understanding how the Zestimate is calculated, along with its strengths and weaknesses, can provide the real estate pro with an opportunity to demonstrate their expertise.Millions of consumers visit Zillow every month. Most understand that the Zestimate is exactly that, an estimate of the value of a home. Occasionally however, someone will come along that insists on setting the price they are willing to buy or sell for based solely on the Zestimate.

Education is the key. As a real estate professional one thing you are always doing is educating your clients on all things real estate. The Zestimate is no different. Armed with an understanding of how the Zestimate is calculated and the Zestimate Data Accuracy table, you can explain - and show Zillow's own accuracy numbers and talk about why the Zestimate is a good starting point as well as a historical reference, but it should not be used for pricing a home.

Be proactive. Look at what Zillow says about properties your client is interested in and bring up any concerns before your client does.

"Zestimate calls" tend to come from consumers who are highly engaged and interested in real estate. If a consumer is to the point where they are examining Zestimates and pricing, they tend to be further along in their search for a home and agent than most.

Keep in mind real estate services are negotiable. 3.5% low commissions is about as low as it gets.

La Grange, Il

Brookfield, Il

Western Springs, Il

If you've ever gone through the mortgage process, you know about closing costs. Most likely you were given a list of costs associated with the mortgage and told to either bring the money to closing or roll the costs into your mortgage. But, if this is your first mortgage, you're still getting used to the concept of paying more money, beyond your down payment. Usually, closing costs are paid by the person purchasing the home, but with some mortgages (VA for example) the seller can pay closing costs. A little-known fact is that a big part of costs and fees actually go to third parties who process the mortgage, as well as local governments as taxes. The money doesn't go to the mortgage company.

Most people take closing costs and fees for granted and just pay what they are told. They don't question the mortgage or title company about the costs associated with a mortgage closing. That's too bad, because they should.

As an informed mortgage customer, you should make your mortgage broker or banker walk you through each cost, and explain in detail what you are paying. The bottom line is that you don't want to be surprised at the last moment. Imagine getting a call from your mortgage banker the day of your closing with a message that your closing costs are $1,200 more than you thought. And the only explanation is that the title company made a mistake. Chances are you may have to reschedule your closing to get the money together for the difference, or have your mortgage adjusted to have the amount rolled in.

To avoid a situation like this, it's a good idea to know exactly what the costs and fees are, how they are calculated, and why you (or the seller) have to pay them. Here's a breakdown of the most common closing costs and fees with a rough estimate of average cost:

- Appraisal (up to $450) - This is paid to the appraisal company to confirm the fair market value of the home.

- Credit Report (up to $30) - A Tri-merge credit report is pulled to get your credit history and score. You cannot supply your consumer pulled report and the scores pulled form the internet from any place other than myfico.com are not real scores nor are they accurate.

- Closing Fee or Escrow Fee (generally calculated a $2.00 per thousand of purchase price plus $250) - This is paid to the title company, escrow company or attorney for conducting the closing. The title company or escrow oversees the closing as an independent party in your home purchase. Some states require a real estate attorney be present at every closing

- Title Company Title Search or Exam Fee(varies greatly) - This fee is paid to the title company for doing a thorough search of the property's records. The title company researches the deed to your new home, ensuring that no one else has a claim to the property.

- Survey Fee (up to $400) - This fee goes to a survey company to verify all property lines and things like shared fences on the property. This is not required in all states.

- Flood Determination or Life of Loan Coverage (up to $20) - This is paid to a third party to determine if the property is located in a flood zone. If the property is found to be located within a flood zone, you will need to buy flood insurance. The insurance, of course, is paid separately.

- Courier Fee (up to $30) - This covers the cost of transporting documents to complete the loan transaction as quickly as possible.

- Lender's Policy Title Insurance (Calulated from the purchase price off a rate table. Varies by company) - This is insurance to assure the lender that you own the home and the lender's mortgage is a valid lien. Similar to the title search, but sometimes a separate line item.

- Owner's Policy Title Insurance (Calulated from the purchase price off a rate table. Varies by company) - This is an insurance policy protecting you in the event someone challenges your ownership of the home.

- Natural Hazards Disclosure Report -Required by law in the state of California for the seller to give the buyer. Reports run between $90 to $150. May be required by other states

- Homeowners' Insurance ($300 and up) - This covers possible damages to your home. Your first year's insurance is often paid at closing.

- Buyer's Attorney Fee (not required in all states - $400 and up)

- Escrow Deposit for Property Taxes & Mortgage Insurance (varies widely) - Often you are asked to put down two months of property tax and mortgage insurance payments at closing.

- Transfer Taxes (varies widely by state & municipality) - This is the tax paid when the title passes from seller to buyer.

- Recording Fees (varies widely depending on municipality) - A fee charged by your local recording office, usually city or county, for the recording of public land records.

- Processing Fee (up to $1,000) - This goes to your lender. It reimburses the cost to process the information on your loan application.

- Underwriting Fee (up to $795) - This also goes to your lender, covering the cost of researching whether or not to approve you for the loan.

- Loan Discount Points (often zero to two percent of loan amount) - "Points" are prepaid interest. One point is one percent of your loan amount. This is a lump sum payment that lowers your monthly payment for the life of your loan.

- Pre-Paid Interest (varies depending on loan amount, interest rate and time of month you close on your loan) - This is money you pay at closing in order to get the interest paid up through the first of the month.

- Property Tax (usually 1 year of county property tax typically prorated up to the date you own the property)

- Wood Destroying Pest Inspection and Allocation of Costs - If required by the lender or buyer, the inspection generally runs up to $125.00. Repairs can get expensive if evidence of termites, dry rot or other wood damage is found. example: Fumigation of a typical 1500 square foot house could run around $2,000.

- Home Owners Association Transfer Fees - The Seller will pay for this transfer which will show that the dues are paid current, what the dues are, a copy of the association financial statements, minutes and notices. The buyer should review these documents to determine if the Association has enough reserves in place to avert future special assessments, check to see if there are special assessments, legal action, or any other items that might be of concern. Also included will be Association by-laws, rules and regulations and CC & Rs. The fee for the transfer varies per association ,but generally around $200-$300.

Closing costs and fees are part of a mortgage, and knowing what they are and how much they should be is a good idea. This will put you in a position to challenge a cost or fee that seems exorbitant. Even if everything is correct, you have the right to ask, and your mortgage company has the duty to explain -- in detail -- each and every closing cost and fee.

Diane Tuneman Writer

- Last edited September 01 2015

- Last edited September 01 2015

Author

Adam Butusov

Tripp Butusov